Majority of U.S. Investors Anticipate Interest Rate Hike

Friday, March 27th, 2015

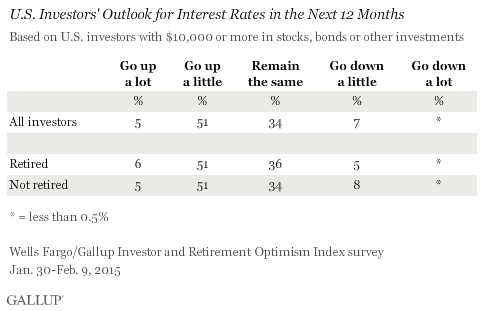

Before the Federal Reserve recently indicated that it may start raising interest rates this summer, the majority of U.S. investors already thought interest rates would go up. About half said they think interest rates will "go up a little" and another 5% said they will "go up a lot." While few investors expected rates to drop, one-third thought they would stay the same.

These findings are from the Wells Fargo/Gallup Investor and Retirement Optimism Index survey for the first quarter of 2015, conducted Jan. 30 to Feb. 9. For this survey, investors are defined as U.S. adults who have at least $10,000 invested in stocks, bonds or mutual funds.

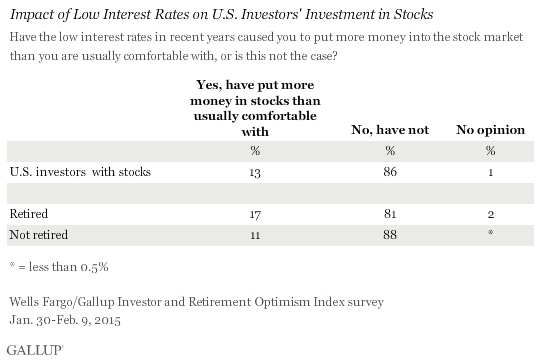

The Fed has not raised interest rates since 2006, after lowering them to practically zero during the recession. That means any increase could be a shock to the market and investors who have become accustomed to extremely low rates. While low rates have been a plus for borrowers, they may have compelled investors to look past CDs and money market accounts now yielding minimal returns, and put more of their investments in the stock market.

In fact, 13% of all U.S. investors, including 17% of retired investors and 11% of nonretired investors, said that low rates have caused them to invest more in the stock market than they are usually comfortable with.

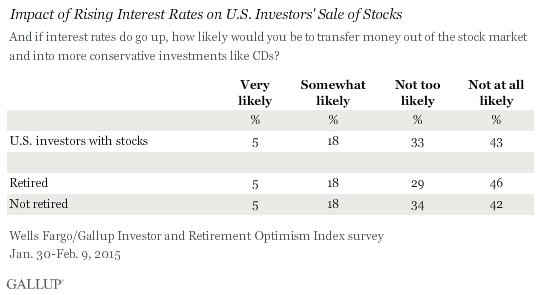

By the same token, rising interest rates could trigger the reverse behavior, driving investors out of stocks and potentially hurting the markets.

In line with this, investors were asked in the Wells Fargo/Gallup survey whether higher interest rates would make them more likely to transfer money out of the stock market and into more conservative investments such as CDs. Most investors said they are "not too likely" (33%) or "not at all likely" (43%) to do this. However, 5% said they are "very likely" and 18% said they are "somewhat likely." That is not a large percentage in absolute terms, but significant in terms of the effect it could have on stock values. Retirees and nonretirees have similar views on this question.

Bottom Line

The Federal Reserve has reportedly wanted to raise interest rates for some time, but it has continually put caution first and not followed through out of concern for the possible effects on the labor market and inflation. So, even though Federal Reserve Board Chair Janet Yellen notably refrained from describing the board as "patient" in discussing their intentions on interest rates, that's a long way from a guarantee that rates are going up at their next meeting in April. Still, even before her statement, more than five in 10 investors believed an interest rate hike is likely in the next 12 months, and nearly one in four were poised to pull back on stocks if interest rates go up, making other, safer investments look more attractive.