Americans Settling on Older Retirement Age

Thursday, April 30th, 2015

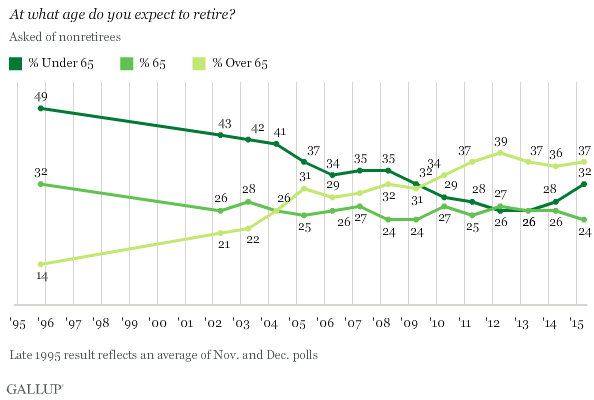

Nearly four in 10 nonretired Americans, 37%, expect to retire after age 65. This percentage is consistent with recent years, but it is up from 31% in 2009 and nearly three times the 14% who said this in 1995. Thirty-two percent expect to retire before age 65; this is the first time this figure has topped 30% since 2009, but it is still down considerably from the 49% in 1995 who said that they expected to retire before age 65.

The percentage of nonretirees who plan to retire exactly at age 65 -- the traditional retirement age -- has been fairly consistent since the early 2000s, ranging between 24%, where it stands today, and 28%. It was only slightly higher in 1995, at 32%.

At the same time, a sea change has occurred in preferences for retiring earlier or later than that age point. Prior to 2009, the plurality of nonretired Americans planned to retire before age 65. Since then, the plurality have said they will retire after they reach age 65.

These trends in Americans' expected age of retirement are from Gallup's annual Economy and Personal Finance survey, conducted April 9-12, 2015. As part of that survey, Gallup asked nonretired Americans the age at which they expect to retire, and also asked retired Americans to report the age at which they retired.

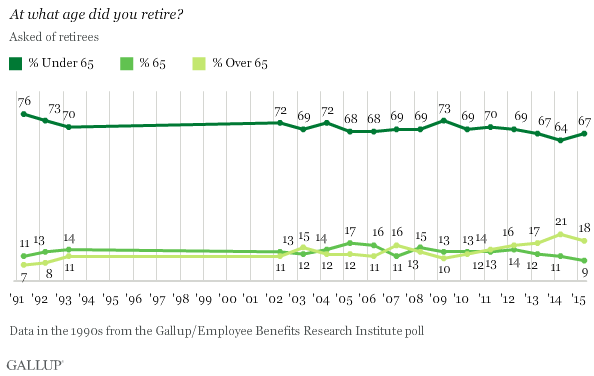

In sharp contrast to the finding that about one-third of nonretirees expect to retire before age 65, twice as many of those who have already retired (67%) said they did so before 65. The percentage of retirees who retired before age 65 has been even higher in past years. In the early 1990s, three in four retired Americans reported retiring before age 65.

Part of the difference between the age when retirees report retiring and when nonretirees expect to retire may be a generation gap, with current workers expecting to live longer and planning to continue working later in their lives. The long-term trends for both retirees and nonretirees suggest that Americans are continuing to work later in their lives -- or planning to do so, if they are not already retired. This does not seem to be the case, however, with baby boomers, as only a third of the oldest in this generation, who are 67 and 68 currently, are still working.

On average, nonretired Americans expect to retire at age 65, similar to averages of between 65 and 67 since 2009. The average age retired Americans report actually retiring has always been lower than nonretirees' expected age of retirement, and is 60 in this year's survey, matching the average generally found since 2004. Prior to that, the average reported age of retirement was always below age 60.

Implications

Concerns about affording retirement, especially because of the recession, could persuade Americans to wait to retire, or to plan to retire later. A recent Wells Fargo/Gallup Investor and Retirement Optimism Index Survey found that 28% of nonretired investors are "very confident" they will have enough saved when they retire. And the 36% of nonretirees who expect to rely heavily on Social Security to fund their retirement is almost 10 percentage points higher than Gallup found a decade ago. But, many fear the Social Security fund could run out of money before those currently working reach retirement. However, many nonretired Americans who say they plan to retire after the traditional retirement age of 65 could be doing so by choice, rather than out of financial necessity.

Gallup has always found an age gap between when nonretirees say they plan to retire and the age when retired Americans report retiring. Over the past decade, and especially since 2009, an increasing percentage of nonretired Americans report expecting to retire after age 65. Yet a third of nonretired Americans say they expect to retire before age 65, similar to levels in 2009.