Ratings of U.S. Banking Industry Level Off

Monday, August 31st, 2015

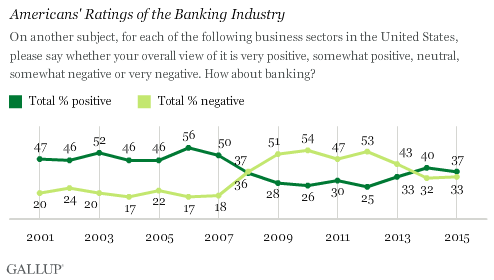

After two consecutive years of improvement in Americans' ratings of the banking industry, climbing from a low of 25% in 2012 to 40% in 2014, perceptions have leveled off. Now, 37%

view the industry positively. The banking industry's image remains better than it was during the economic downturn but is still not back to the more positive levels seen from 2001 to 2007.

The latest results are based on Gallup's annual Work and Education survey. As part of the poll, Gallup asks Americans for their views on 25 different business or industry sectors, using a 5-point positive-to-negative scale. Banking's +4 net rating (based on 37% rating it very or somewhat positive and 33% very or somewhat negative) is below the average of +16 for all 25 industries, but ranks ahead of several industries with net-negative ratings, such as the federal government, the oil and gas industry, the healthcare industry and the pharmaceutical industry.

Americans were positive toward the banking industry in Gallup's initial annual reading in August 2001, and these upbeat views were consistent through August 2007, a few months before the recession officially began. During this period, an average of 49% of Americans rated the industry positively and 20% negatively, for an average +29 net rating.

In August 2008, as the recession was deepening but a month before the September financial crisis, Americans were evenly divided in their views of the banking industry -- 36% positive and 37% negative.

From 2009 through 2012, Americans' ratings of banks were substantially more negative than positive, with an average -24 net rating.

After bottoming out at 25% positive (and 53% negative) in 2012, Americans' views of the industry began to recover, with an eight-percentage-point increase in positive ratings in 2013 and a seven-point increase in 2014, enough to push its positive ratings ahead of its negative ratings for the first time since 2007.

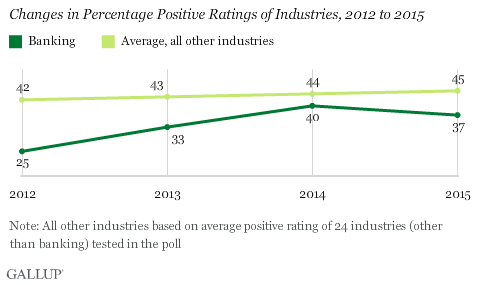

Many, but not all, industries have seen increased positive ratings over the last four years. The total 12-point increase in ratings of the banking industry since 2012 exceeds the average three-point increase for the 24 other industries included in the survey.

Along with the banking industry, the real estate (up 13 points), oil and gas (up 12 points), travel (up 12 points) and electric and gas utility (up 10 points) industries have shown double-digit increases in their positive ratings since 2012.

Lower-Income Americans Rate Banking Industry Most Positively

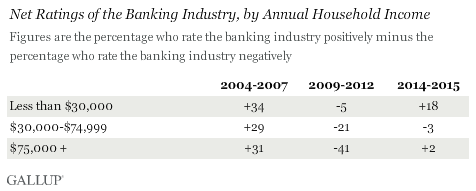

Forty-four percent of Americans whose annual household income is less than $30,000 have a positive view of the banking industry, while 26% view it negatively, resulting in a +18 net rating, based on combined 2014-2015 polling. That compares with net ratings of -3 among middle-income Americans (35% positive, 38% negative), and +2 among upper-income Americans (37% positive, 35% negative).

Lower-income Americans did not always view the industry more positively than Americans at higher income levels. Prior to the recession, from 2004 through 2007, net ratings of the banking industry were largely similar by income level, ranging from +29 to +34 among the three income groups.

After the financial crisis and recession, from 2009 to 2012, views of the industry cratered among all income groups, but much more so among upper-income Americans than among middle- or lower-income Americans. The average net rating of the banking industry among upper-income Americans fell a staggering 72 points in the years bracketing the 2008 financial crisis, from +31 to -41, compared with drops of 50 points among middle-income Americans (from +29 to -21) and 39 points among lower-income Americans (from +34 to -5).

Upper-income Americans, who are more likely to have money invested in the financial markets, and were probably more likely to be aware of the problems facing U.S. financial institutions as the crisis unfolded, appear to have been more shaken by the industry's problems. Upper-income Americans' ratings of the industry have recovered during the last two years, improving a total of 43 points, from -41 to +2, a greater improvement than for the other income groups. But that improvement left upper-income Americans about as positive toward the industry as middle-income Americans, and still significantly less positive than lower-income Americans.

Among Political Groups, Republicans Most Positive Toward Banks

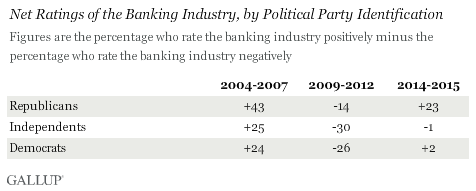

The Republican Party is sometimes referred to as the party of "Wall Street," and ratings of the banking industry by political party are consistent with that description. Forty-six percent of self-identified Republicans view the industry positively and 23% negatively, for a net rating of +23. Meanwhile, independents (35% positive and 36% negative) and Democrats (39% positive and 37% negative) are divided in their views of the industry.

Each political group showed similar declines in ratings of banks after the financial crisis, with the net score for each falling between 50 and 57 points. Republicans' views of banks have improved slightly more over the last two years.

Implications

For now, the positive momentum in Americans' images of the banking industry has halted. Slightly more Americans have a positive than negative view of banks, a much better evaluation of the industry than during the recession and its aftermath, but still lagging behind the more positive images that existed before then.

Gallup has shown a similar pattern in Americans' confidence in the institution of banks, which bottomed out in 2012 and has improved modestly since then, although that increase also appears to be leveling off.

These trends could indicate that those who were most likely to forgive the industry or forget the problems that plagued it have already done so, and the industry may need to convince those with longer memories or greater skepticism that banks have reformed their ways and that the industry has changed for the better. Thus, it appears the banking industry still has work to do to regain the positive image and trust it had before the recession.